HR Compliance Made Easy: How HRMS Tools Prevent Legal Risks

In today's regulatory environment, ensuring compliance in HR is not just important—it's essential. From tax filings and labor laws to diversity reporting and employee safety, HR professionals juggle a complex web of compliance requirements. A single oversight can cost a company millions in fines or lawsuits.

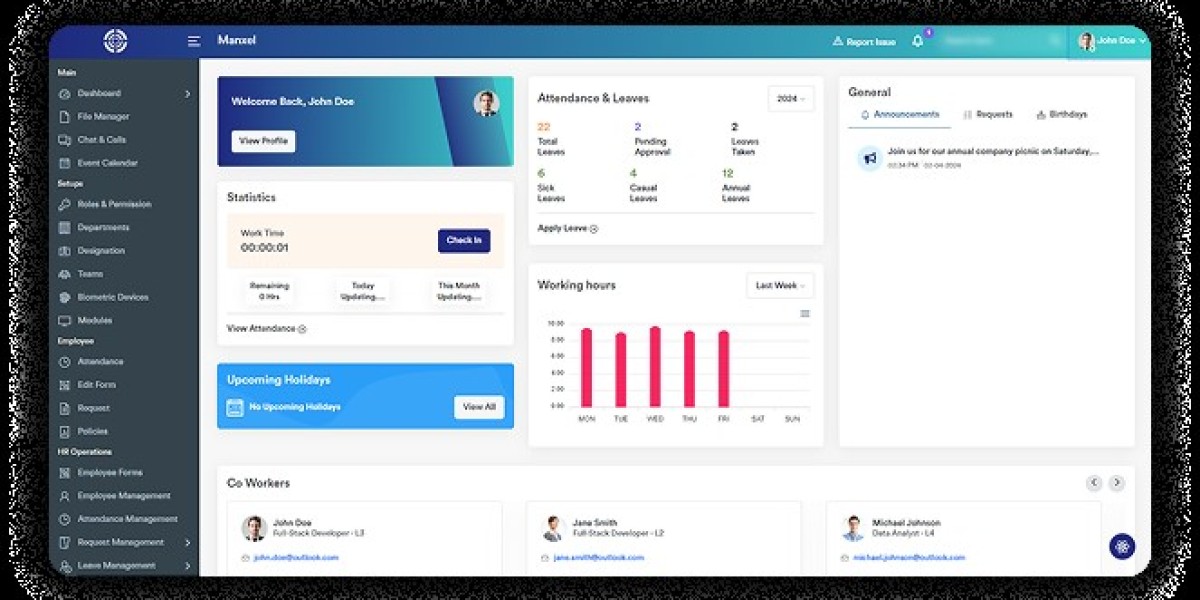

Enter the modern Human Resource Management System (HRMS) — a powerful ally in achieving and maintaining HR compliance. In this post, we’ll explore how HRMS platforms, especially Manxel HRMS, simplify compliance, automate risk management, and create audit-ready processes for your HR team.

? What Is HR Compliance?

HR compliance refers to the alignment of an organization’s human resources policies and practices with local, state, national, and international labor laws and regulations. This includes:

Labor laws and employee rights

Tax reporting and payroll standards

Health and safety requirements

Anti-discrimination laws

Data protection (like GDPR or HIPAA)

Workplace diversity reporting

Contract and wage agreements

Failure to comply can result in serious penalties, damaged reputation, or employee lawsuits.

? Common HR Compliance Challenges

Tracking constantly changing laws

Maintaining accurate records

Timely submission of government forms

Monitoring overtime and minimum wage

Handling discrimination complaints properly

Managing diverse legal jurisdictions (especially for remote teams)

Manual processes make these tasks prone to human error. This is where a robust HRMS becomes essential.

? How HRMS Platforms Ensure Compliance

1. Automated Recordkeeping

HRMS platforms digitally store employee files, contracts, performance reviews, tax documents, and more. These records are time-stamped, searchable, and accessible for audits.

With Manxel HRMS:

All documents are stored securely in the cloud

No paperwork is lost or misfiled

Audit trails are automatically maintained

2. Payroll & Tax Compliance

Tax laws, benefit deductions, and payment structures must be calculated precisely. HRMS platforms automate:

Tax filings and updates

Pay slip generation

Compliance with minimum wage laws

Benefit contributions and deductions

Manxel HRMS handles country-specific compliance rules and payroll structures, reducing risks during financial audits.

3. Work Hours & Overtime Monitoring

HRMS tracks:

Employee hours

Overtime calculations

Break compliance

Remote attendance logs

This protects companies from non-compliance lawsuits related to labor law violations.

4. Policy Acknowledgment & E-signatures

HRMS platforms let employees:

Sign and acknowledge HR policies

View updates in real-time

Maintain digital trails of consent

Manxel HRMS supports digital document verification, ensuring compliance with workplace policies.

5. Workplace Safety & Training Logs

Compliance with workplace safety laws often includes employee training, incident reporting, and safety protocols.

HRMS systems help by:

Scheduling training sessions

Tracking participation

Logging safety certifications

This ensures your company is ready for safety audits and workplace inspections.

6. GDPR & Data Protection

HRMS solutions implement:

Role-based data access

Consent management tools

Data encryption at rest and in transit

Manxel HRMS ensures GDPR readiness and helps HR teams handle employee data ethically and legally.

? Why Manxel HRMS Is a Compliance Champion

Manxel HRMS integrates compliance directly into the HR workflow:

Policy Management: Automate employee handbooks and signatures

Leave & Time Rules: Customize based on local labor laws

Data Security: Bank-grade encryption for sensitive HR data

Built-in Audit Reports: Generate reports instantly for authorities

Notification Alerts: Never miss a deadline or policy update

? Explore Manxel’s compliance-focused HR features: http://manxel.com/products/hrms/

✅ Benefits of Compliance-Ready HRMS Platforms

| Feature | Benefit |

|---|---|

| Automated Updates | Stay aligned with new laws |

| Document Control | Easy audits and reduced legal risk |

| Payroll Accuracy | Prevent tax errors and fines |

| Policy Acknowledgment | Ensure employee awareness |

| Training Management | Maintain safety and legal standards |

| Access Control | Protect personal and confidential data |

? Real Costs of Non-Compliance

| Violation Type | Average Fine (USD) |

|---|---|

| Wage Law Violation | $5,000 – $50,000+ |

| Tax Filing Errors | $100 – $10,000+ |

| Data Breaches (HR) | $100,000+ |

| Discrimination Lawsuit | $75,000 – $300,000 |

Investing in HRMS is far cheaper than dealing with compliance violations.

? Compliance in a Hybrid & Global Workforce

With global hiring and remote teams, HR teams face jurisdiction-specific laws and tax codes.

Manxel HRMS offers:

Customizable compliance settings

Local law templates

Real-time alerts across regions

This ensures you’re compliant—no matter where your employees work.

? Final Thoughts

Compliance doesn’t have to be a burden. With the right HRMS, it becomes a streamlined, automated, and intelligent process. By choosing a system like Manxel HRMS, your business can stay ahead of legal risks, save time, and foster a more transparent, ethical workplace.

✅ TL;DR

HR compliance is complex but critical. A modern HRMS like Manxel HRMS automates recordkeeping, payroll accuracy, policy tracking, and legal readiness to protect your organization from risk.

? Visit: http://manxel.com/products/hrms/

? Resource Box

Simplify HR compliance with Manxel HRMS. From payroll to policy tracking, stay audit-ready and legally secure. Visit: http://manxel.com/products/hrms/

? Meta Description (SEO)

Avoid costly HR mistakes. Discover how Manxel HRMS helps ensure full HR compliance with automated workflows, audit trails, and built-in legal safeguards.